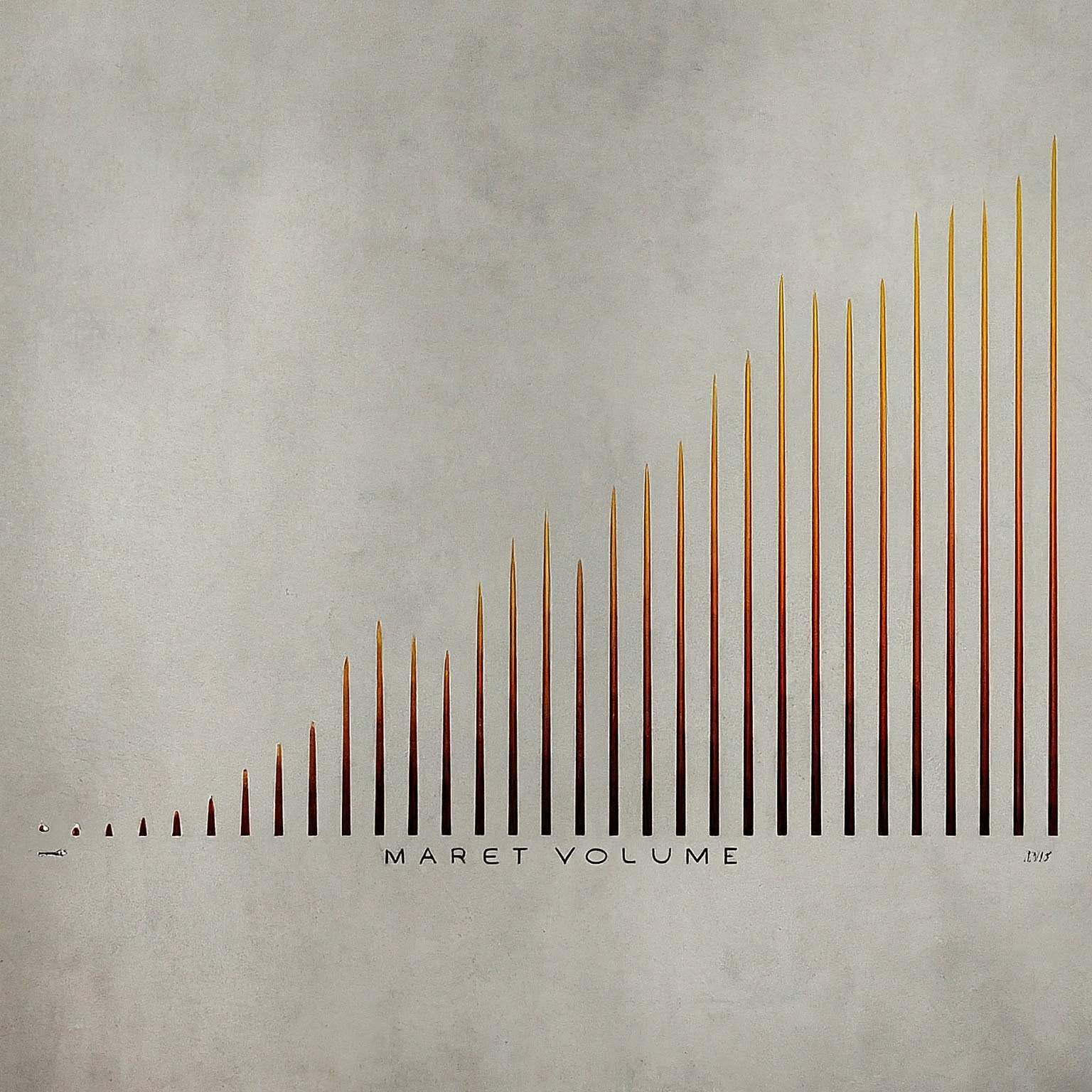

Decoding Market Volume for Better Trade Decisions

Understanding market volume is critical for traders aiming to make well-informed decisions. Volume, the total number of shares or contracts traded in a given period, serves as a powerful indicator of the strength behind price movements and potential future trends. In this article, we’ll explore the importance of volume analysis in trading, discuss various volume-based indicators, and offer strategies for incorporating volume into trading decisions.

The Basics of Market Volume

Market volume represents the number of units traded for a particular asset over a specific time frame. It is a direct measure of liquidity and volatility, critical factors that affect how you might enter or exit a trade. High volume indicates a high interest in the asset at its current price, and it often precedes significant price movements.

1. Volume and Price Movement

The relationship between volume and price movements is fundamental. Generally, an upward price movement with increased volume is seen as bullish, while an upward movement on low volume might be considered weak and unsustainable. Conversely, a price decline on high volume could be a bearish signal, indicating strong selling interest.

2. Volume Trends

Consistent increases or decreases in volume can signal the strength of a trend. Rising volume alongside a price trend suggests that the trend is backed by strong trader commitment and is likely to continue. Declining volume, however, may signal that a trend is weakening and possibly nearing its end.

Key Volume Indicators

Volume indicators are tools that help traders understand market dynamics and anticipate future movements. Here are some of the most commonly used volume indicators in trading:

1. Volume Moving Average

The Volume Moving Average smooths out volume spikes and can help identify trends. A rising volume moving average often confirms a bullish trend, whereas a falling volume moving average can suggest bearish conditions.

2. On-Balance Volume (OBV)

OBV uses volume flow to predict changes in stock price. The theory is simple: volume precedes price movement. OBV adds up volume on “up” days and subtracts volume on “down” days. If the OBV is rising, it suggests that buyers are willing to step in and push prices higher.

3. Accumulation/Distribution Line (A/D Line)

The A/D Line helps identify whether money is flowing into or out of a stock. It is calculated by looking at the closing price relative to the range for the day and then multiplying by volume. If the stock closes near its high with substantial volume, the A/D line will rise, indicating accumulation.

4. Volume Price Trend (VPT)

VPT combines volume and price to provide a cumulative measure that helps in confirming the price trend. An increasing VPT suggests that buying pressure is increasing, thus confirming an uptrend; conversely, a decreasing VPT can indicate increasing selling pressure.

Volume Analysis in Action

Let’s look at how volume analysis can influence trading decisions through a few strategies:

1. Breakout Trading

When a stock price breaks out from a range or key resistance level on high volume, it is a strong indicator that the breakout is valid and the price could continue to move in the direction of the breakout. Traders might take this as a signal to enter a long position.

2. Reversal Identification

A sudden spike in volume can indicate a potential price reversal. For instance, if a stock is in a downtrend and suddenly a large volume spike occurs at a new low price, this could signal that the bottom has been reached, and a reversal might be near.

3. Volume Divergence

Volume divergence occurs when there’s a discrepancy between price direction and volume trend. For example, if prices are reaching higher highs, but volume is dwindling, it might suggest the uptrend is losing steam and could reverse soon.

Best Practices for Volume Trading

While volume is a vital tool in the trader’s toolkit, it’s important to combine volume analysis with other indicators and methods to validate trading signals. Here are some best practices:

1. Combine Volume with Price Action

Always look at volume in conjunction with price action. Volume can provide context to price movements, making patterns more or less significant.

2. Use Multiple Indicators

Incorporate other technical indicators such as moving averages, RSI, and MACD to confirm what volume is suggesting. This multi-faceted approach can reduce the risk of false signals.

3. Consider the Context

Market conditions, news events, and economic data releases can all impact volume. It’s crucial to consider these factors when interpreting volume data to avoid misjudgments.

Conclusion

Volume is more than just a number; it’s a powerful tool that, when decoded properly, can significantly enhance trading decisions. By understanding how to read and interpret volume alongside other market indicators, traders can gain a clearer insight into market dynamics and make more informed decisions. Remember, successful trading is about using every tool available to understand the market’s movements and sentiments. Volume analysis is one of those essential tools that should not be overlooked.

No Responses